Table of Contents

ToggleWhy do the fundamental analysis necessary to invest in stock market?

Fundamental Analysis:

Fundamental analysis is a Holistic approach to study a business to invest in a business for the long term (say 3 to 5 years), it comes highly essential to understand that business from various aspects for an investor.

It is too critical for an investor to separate the daily ups & down Price noise of the stock and concentrate on the underlying business performance of that stock.

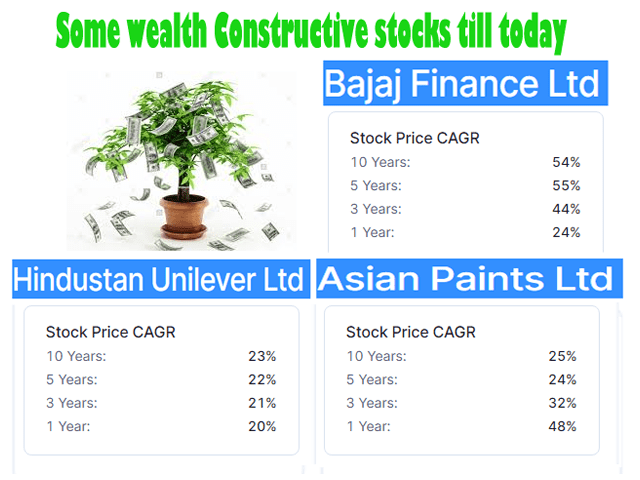

History of some wealth created stocks till today

history is evident that over a long time the stock price of fundamentally strong companies tends to appreciate thereby creating wealth for their investor. Many such examples in the Indian market are there. To name a few, one can think of companies such as TCS Ltd , Deepak nitrite, KEI, Tata Consumer Products Ltd, etc

History of few stocks having 20-30 percent CAGR

many companies like Bajaj Finance, Hindustan Unilever, Asian Paints, Eicher Motors, Nestle India, TTK Prestige, etc. each of these companies have delivered on an average over 20% compounded annual growth return(CAGR) on year for over 10 years. To give you a prospective at 20% CAGR the investor would double his money in roughly about 3.5 years. The higher the CAGR, the faster is the wealth creation process. some companies such as Bajaj Finance have delivered close to 54% CAGR.

Therefore you can imagine the magnitude and the speed at which wealth is created. Everyone would invest in fundamentally strong companies, that can set you thinking about long-term wealth creation. You do remember there are just a few examples among the many that you may find in the Indian market at this point.

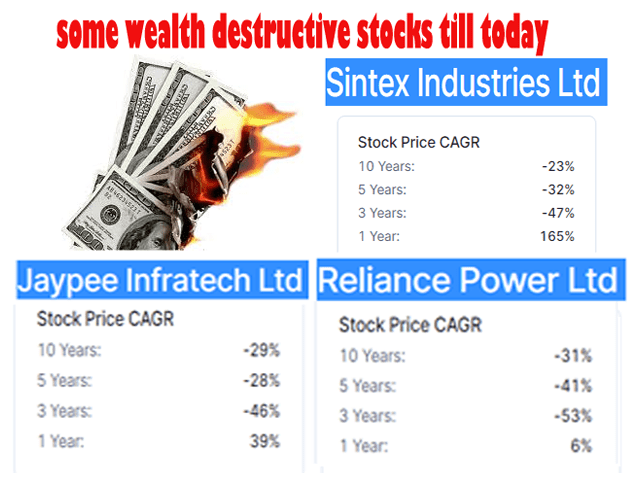

History of some wealth destructive stocks till today

you may be of the opinion that I am Biased as I am selectively posting charge that looked impressive. you may wonder how the long-term CAGR of Sintex Industries, Reliance Power, Jaypee Infratech Ltd, may look? well here are the long term starts of these companies. These are just examples of wealth destructors amongst the many you may find in the Indian markets.

That has always been to separate the investment-grade companies which create wealth from the companies that destroy wealth.

All investment-grade companies have a few common attributes that set them apart likewise are well destructors have a few common traits which are clearly visible to an astute investor.

Fundamental analysis is the technique that gives you the conviction to invest for the long term by helping you identify these attributes of wealth-creating companies.