Mutual funds meaning (Concept)

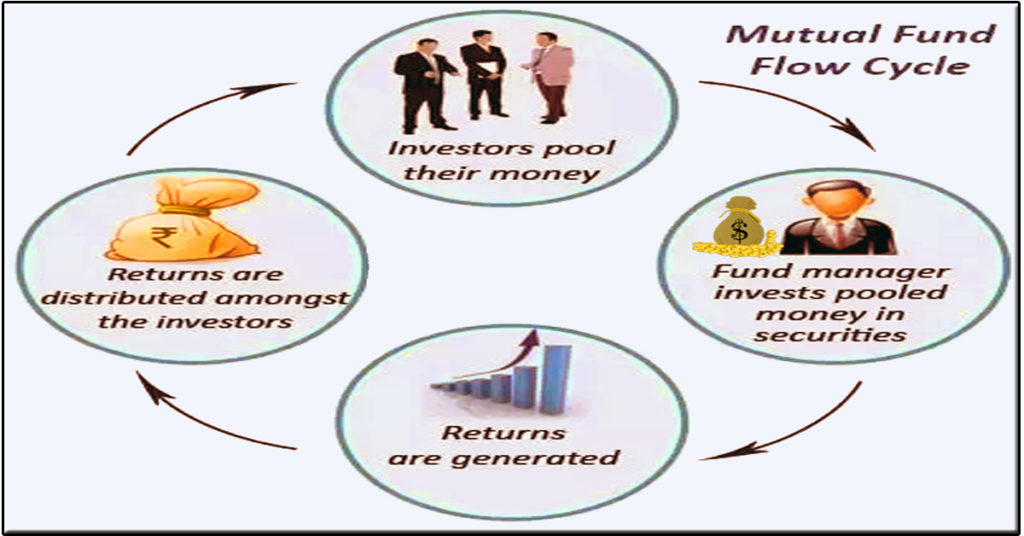

Mutual funds are a kind of collected pool money from many investors to invest in various aspects for creating wealth. The Collected pool money is used to buy other securities, usually stocks and bonds (Which is called the Portfolio).

performance of the portfolio or securities drives the value of the mutual funds company to decide buy.

So, when you buy a unit or share of mutual funds means you are buying the performance of its portfolio or more precisely a part of the portfolio’s value.

Who and how Operates the collected pool of money

Collected pool money is operated by professional money managers, who allocate the fund’s assets and attempt to produce capital gains or income for the fund investors.

The portfolio of mutual funds is structured and maintained to match the investment objectives stated in its prospectus. Investing in a share of mutual funds is somehow different from investing in shares of stock.

Mutual funds shares do not give any voting rights to their holders as like stocks. Simply buying a share of mutual funds represents investments in many different stocks (or other securities) instead of just one holding.

What represents the term “NAV” in Mutual Funds

So the price of a mutual funds share is referred to as the net asset value (NAV) per share, sometimes it is also expressed as NAVPS.

The calculation of NAV is derived by dividing the total value of the securities in the portfolio by the total amount of shares outstanding. Outstanding shares are those securities held by all shareholders, institutional investors, and company officers or insiders.

Typically the Mutual funds units can be purchased or redeemed at any time as needed at the fund’s current NAV, which—unlike a stock price—doesn’t fluctuate during market hours. But, at the end of each trading day, NAV is settled.

The average mutual funds holds many different securities, which results in mutual funds shareholders getting the benefit of important diversification at a low price.

Why Mutual Funds are A safe bet as compared to Direct investment in the Stock Market?

Many of the investors don’t bother about the deep knowledge of the share market. Either they invest all their money at a time in a single stock or in a few stocks.

But a lack of knowledge in Money management, Fundamental and Technical Analysis they fail to build a good Portfolio. That makes them intolerant of the volatility of the Market. Which makes them bound to book a massive loss with their invested money.

Consider an investor buying only TATA Motors stock before the company has a bad quarter. He stands to lose a great deal of value because all of his money is tied to one company.

But On the other hand, at the same time, any other investor may buy shares of a mutual fund that happens to own some TATA Motors stock. When TATA Motors has a bad quarter, that investor loses significantly less because TATA Motors is just a small part of that fund’s portfolio.

Types of Mutual Funds

Mutual funds are categorized into several kinds in keeping the view to their mode of investment or representing the kinds of securities they have their portfolio types and the target of returns they seek.

Some common types of mutual funds include sector funds, money market funds, smart-beta funds, alternative funds, target-date funds, and even funds-of-funds, or mutual funds that buy units of other mutual funds.

Equity Funds

Equity or stock funds: It is the largest category of Mutual funds. As the name reflects equity, this sort of fund invests principally in stocks or shares.

There are various subcategories available in equity funds. Some equity funds are named by the size of the companies they invest in: small-, mid-, or large-cap. Some are named with their investment approach: aggressive growth, value, income-oriented, and others.

Equity funds are also categorized by their investment type, whether they invested in foreign equities or domestic (U.S.) stocks. Many different types of equity funds are There because there are many different types of equities.

Index Funds

Index Funds are extremely popular In the last few years. This category falls under the moniker “index funds.” Their investment strategy of them is based on the belief that it is very hard, and often expensive, to try to beat the market consistently.

So, the fund manager buys stocks that correspond with a major market index such as the S&P 500 or the Dow Jones Industrial Average (DJIA). The Index funds are often designed with cost-sensitive investors in mind.

Fixed-Income Funds

Another popular group is the fixed income category. Such a category of mutual funds focuses on investments that pay a set rate of return, such as corporate bonds, government bonds, or other debt instruments.

The aim is that the fund portfolio generates interest income, which it then passes on to the shareholders. Sometimes referred to as bond funds, which are often actively managed and seek to buy relatively undervalued bonds in order to sell them at a profit.

These mutual funds are likely to manage higher returns than certificates of deposit and money market investments, but bond funds aren’t without risk. Because many different types of bonds are there, bond funds can vary dramatically depending on where they invest.

For example, a fund that invests in government securities is much more secure than a riskier fund specializing in high-yield junk bonds. Further, nearly all these bond funds are subject to interest rate risk, which means that if rates go up, the value of the fund goes down.

Balanced Funds

Funds under this category invest in a hybrid of asset classes, whether stocks, money market instruments, bonds, or alternative investments.

To reduce the risk of exposure across asset classes is its main objective. A balanced fund is also known as an asset allocation fund. To cater to the investors’ objectives, two variations of such funds are designed.

Some funds are defined with a fixed allocation strategy, Where Other funds follow a dynamic allocation strategy for percentages to meet various investor objectives.

This may include responding to business cycle changes, market conditions, or the changing phases of the investor’s own life. While the objectives are similar to both of these fixed allocated or dynamic allocated balanced funds.

Income Funds

These funds are named for their purpose: they provide current income on a steady basis. These funds invest primarily in high-quality corporate debt and government by holding these bonds until maturity in order to provide interest streams.

The primary objective of these funds is to provide steady cash flow to investors. These fund holdings may appreciate in value. As such, these funds consist of conservative investors and retirees. Because they produce regular income and are tax-conscious, investors may want to avoid these funds.

Money Market Funds

The money market mostly consists of safe (risk-free), short-term debt instruments, like government Treasury bills. This is one of the best places to park your money safely. You won’t get substantial returns here, but at the same time, you won’t have to worry about losing your principal.

Exchange-Traded Funds (ETFs)

ETFs are more popular investments. They are structured as investment trusts and traded on stock exchanges. ETFs can be bought and sold at any time throughout the trading hour. ETFs carry lower fees than the equivalent mutual funds.

Click here to know more about the best mutual funds to invest in

Comments are closed.