How do a candle form in Candlestick Chart?

Concept of Candlestick Chart

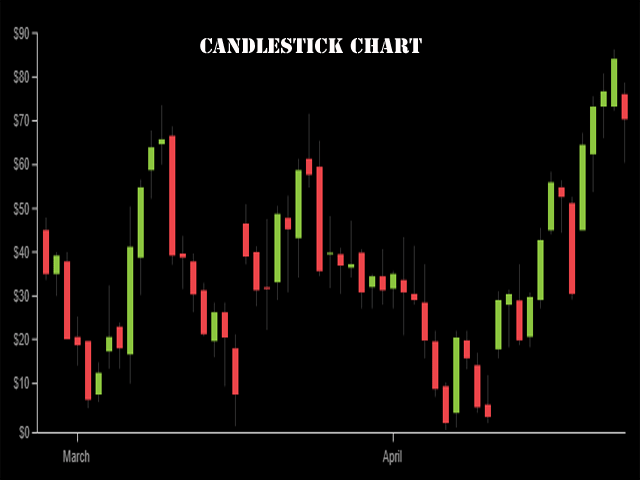

Stock charts are a great tool for technical analysts in the stock market. Candlestick charts are being used widely among traders around the globe. During trading, a kind of design that is formed by a stock with its price action of OPEN-price, LOW-price, HIGH-price, and CLOSE-price in a stipulated time period is called a candle.

Graphical representation of Such candles to gathering forms a candlestick chart. A Candlestick chart provides a holistic idea of the past regarding the price action that happened with the stock during a stipulated period of time.

Most of the traders having technical analytic skills depend on this Visual representation of a candlestick chart to predict the future price of that stock whether Bull, Bear, or Consolidated Phase.

Let’s try to understand more about the details of the candle of a candlestick chart.

On the chart, each candlestick indicates the open, high, low, and close price for the stipulated time frame the trader has chosen.

For instance, if the trader sets the time-frame to five minutes, a replacement candlestick is going to be created every five minutes.

For an Intraday chart like this one, the open and Close prices are those for the start and end of the five-minute period, not the trading session.

Candlesticks start with the opening price, the present price as they’re formed, whether the worth moved up or down over the time frame, and therefore the price range of the asset covered therein time.

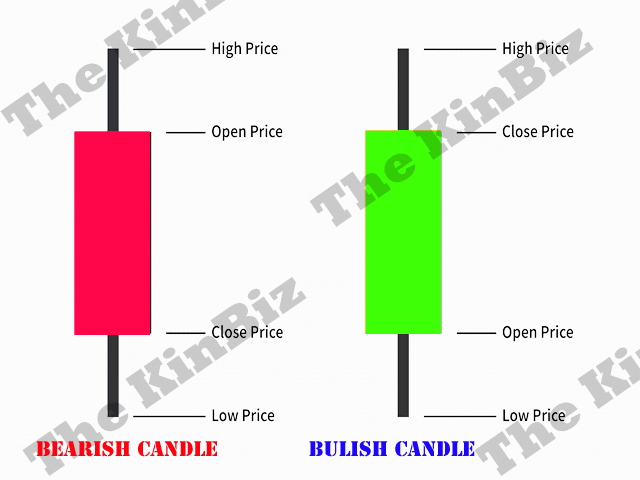

Open Price

The top or bottom of the candle body will indicate the open price, counting on whether the asset moves higher or lower during the five-minute period. If the worth trends up, the candlestick is usually either green or white and therefore the open price is at rock bottom. If the worth trends down, the candlestick is usually either red or black and therefore the open price is at the highest.

High Price

The high price during the candlestick period is indicated by the highest of the shadow or tail above the body. If the open or close was the very best price, then there’ll be no upper shadow.

Low Price

The low is indicated by the rock bottom of the shadow or tail below the body. If the open or close was the lowest price, then there will be no lower shadow.

Close Price

The close is that the last price traded during the candlestick, indicated by either the highest (for a green or white candle) or bottom (for a red or black candle) of the body.

As a candle forms, it constantly changes because the price moves. The open stay is equivalent, but until the candle is completed, the high and low prices are changing. The color can also change as candlestick forms. It may go from green to red, for instance, if the present price was above the open price on the other hand drops below it.

The last price represents the close price when the period of time for the candle ends, And the candle is now completed, then a replacement candle begins forming.

Price Direction

You can see the direction the worth (the price of the stock) moved during the time-frame of the candle by the color and positioning of the candlestick. If the candlestick is green, the worth(the price of the stock) closed above where it opened and this candle is going to be located above and to the proper of the previous one, otherwise it differs in color and size from the previous candle. If the candlestick is red, the worth (the price of the stock) closed below to its open and this candle is going to be located below and to the proper of the previous one with a different color than the previous candle.

Price Range

The distance between the high point of the upper shadow and the low point of the lower shadow indicates the range of the candle that moved through during the time frame of a candlestick. The price range is calculated by subtracting the low price from the high price.