SIP-Systematic Investment Plan

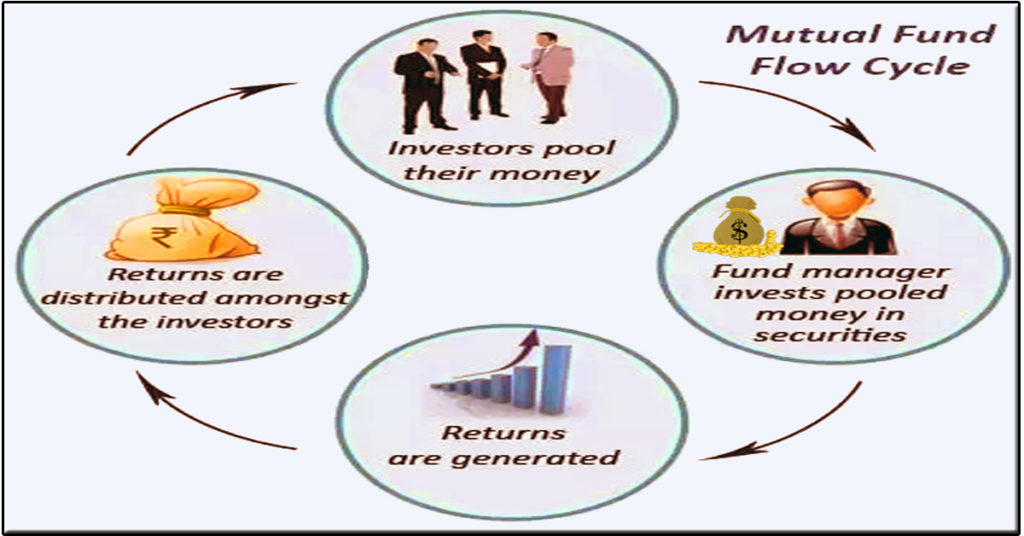

One-time investing in a mutual fund is generally known as a lump sum investment. But SIP is a very easy and good investment plan for all. SIP is the Short form of a Systematic Investment Plan, in which you can invest a certain amount of your free money at predefined regular intervals in mutual funds, which helps you to create a good amount of wealth in the long run by investing small sums of money.

In simple words, a Systematic Investment Plan (SIP) is a planned approach toward investments that helps you to create wealth for the future and inculcate a habit of saving.

Let’s understand, How does the Systematic Investment Plan work?

SIP follows the principle of regular investments. In this scheme, an auto-debit system also works where the amount to be invested is auto-debited from your account periodically. So, in a SIP, you need not get time the market, On the specified given date it buys the number of units monthly with that particular debited amount from your account. The Units bought depend upon the value of NAV on that particular date.

More units will be bought if the price is low and on the other hand If the price of the unit is high on that day, low units will be bought with the same amount.

Top SIP Plans to Invest in India are Listed Below for 2021

- SBI Blue Chip Fund (Click here)

- HDFC Balanced Fund (Click here)

- Reliance Small Cap Fund (Click here)

- SBI Small Cap Fund (Click here)

- Aditya Birla Sun Life Tax Relief 96 (Click here)

- ICICI Pru Balanced Mutual Fund (Click here)

- Mirae Asset Emerging Bluechip Fund (Click here)

- Franklin India Higher Growth Companies Fund (Click here)

- ICICI Pru Focused Blue Chip Fund (Click here)

- Kotak Emerging Equity Fund (Click here)

- Canara Robeco Bluechip Equity Fund (Click here)

- Mirae Asset Tax Saver Fund (Click here)

- Tata India Tax Savings Fund (Click here)

Systematic investment plan benefits

The benefits of SIP can be understood easily by knowing its common features and advantages. which are described below.

Common Features of Systematic Investment Plan

- An investor can start investing in SIP at any time.

- SIP allows us to withdraw the invested money at any time if the investor needs it.

- It has no fixed tenure. It often stops in between and maybe continued after the tenure by placing an invitation to the open-end fund company.

- The partial or full withdrawal is feasible during or after the SIP tenure.

- During the period of the SIP tenure, the amount to invest in a SIP can be increased or decreased by the investor as his/her wishes.

Advantages of Systematic Investment Plan

- Disciplined approach: You don’t need to plan how much to invest, when to invest, and where to invest money.

- No need to worry about the time of the market: You don’t need to actively monitor the market.

- Averaging your money: You get the benefit of rupee cost averaging, an effective investment strategy, e.g. A fixed amount is invested every month, so it happens to buy more units when the price is low and fewer units when the price is high.

- Power of compounding: you are investing a small amount of your free money regularly. That installed money grows to a large sum comprising of your own contributions and returns compounded over the years.

- Power of starting early: SIP allows you to start investing early. The earlier you start investing, the easier it will be for your wealth creation.

One of the most interesting factors of SIP is

The mutual fund scheme invests in companies in a variety of sectors like IT, Hospitality, Pharmaceuticals, manufacturing, chemicals, etc. It acts as an automatic mechanism of averaging out.

Though it buys fewer units when the worth is high and more units when the worth is low. The value of the NAV is set at the average cost of buying, which results in an improvement in the returns. Further, a Systematic Investment Plan (SIP) allows investing in a mutual fund scheme of your choice.